“The Coronavirus Means Market Turbulence and Weaker Consumer Spending and Investment”

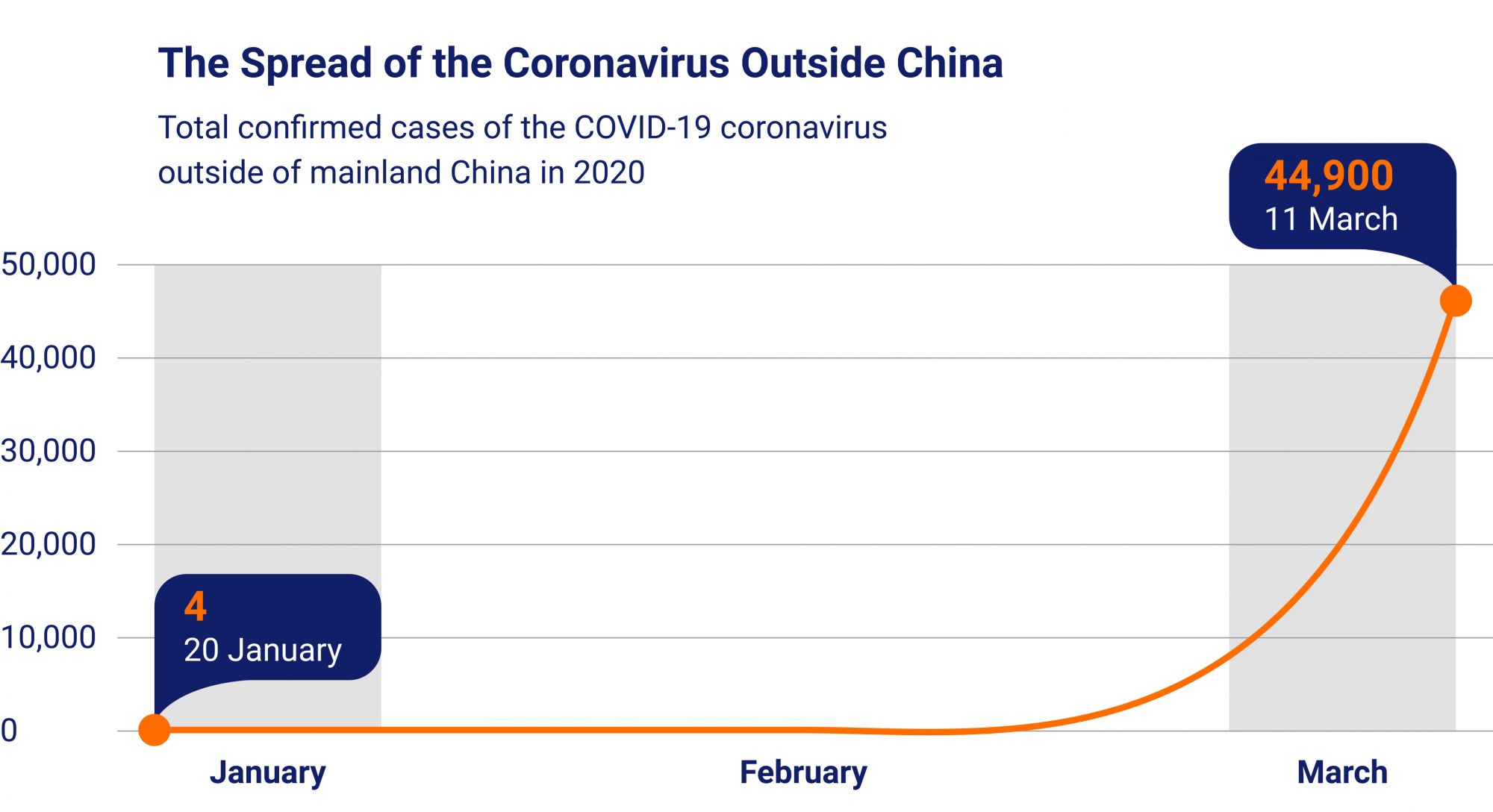

According to the Center for Systems Science and Engineering (CSSE), as of 16 March 2020 there had been 160 000 confirmed cases of the virus, with over 6 500 deaths, of which 3 000 were in China. The fatality rate is believed to be 2%.

Outside China, Covid-19 has spread quite quickly. This “first true pandemic challenge”, according to Statista, has already been recognized as a serious international epidemic.

It is now obvious that the world faces harsh economic challenges due to the rapid spread of this previously unknown pathogen. The Covid-19 coronavirus, originating in China, has already severely impacted much of Europe and the Americas. Many countries have introduced a lockdown. Experts are comparing the scale of the virus and its expected impact to the SARS outbreak in 2003.

According to a recent Oxford Economics report, “Escalation of the coronavirus outbreak means market turbulence and widespread disruption will trigger weaker consumer spending and investment on top of supply-chain impacts”. Stocks have already rapidly decreased. However, the markets seem to react to fears and the omnipresent uncertainty, which means they may swing in the other direction when the news starts to sound more positive.

What’s on the Global Agenda

G7 leaders will be holding a video conference on Tuesday, 17 March 2020 to coordinate their efforts on researching a vaccine and possible treatments to slow the spread of the virus. In addition, they will discuss their economic and financial policy response in order to calm the markets, as French President Emmanuel Macron announced in his Twitter post on Friday, 13 March 2020.

As the IMF Managing Director Kristalina Georgieva stated in her Opening Remarks at a joint press conference with the World Bank Group, about USD 50 billion of emergency financing facilities will be made available by the IMF for low income and emerging markets.

The European Commission called for startups and small and medium-sized enterprises with suitable technologies and innovations to share their expertise and knowledge in order to contribute to treating, testing, monitoring, and other actions to curtail the coronavirus outbreak as urgently as possible.

The ECB announced easing of conditions for targeted longer-term refinancing operations to support bank lending to small and medium-sized enterprises. The loans could be at rates as low as –0.75%. This measure is expected to keep credit flowing to the economies of affected countries.

The Biggest Danger since the Global Financial Crisis

Meanwhile, the world’s policymakers and government leaders have tightened fiscal rules and taken a range of restrictive measures aimed at providing additional liquidity to their economies and tackling the impact of the coronavirus outbreak.

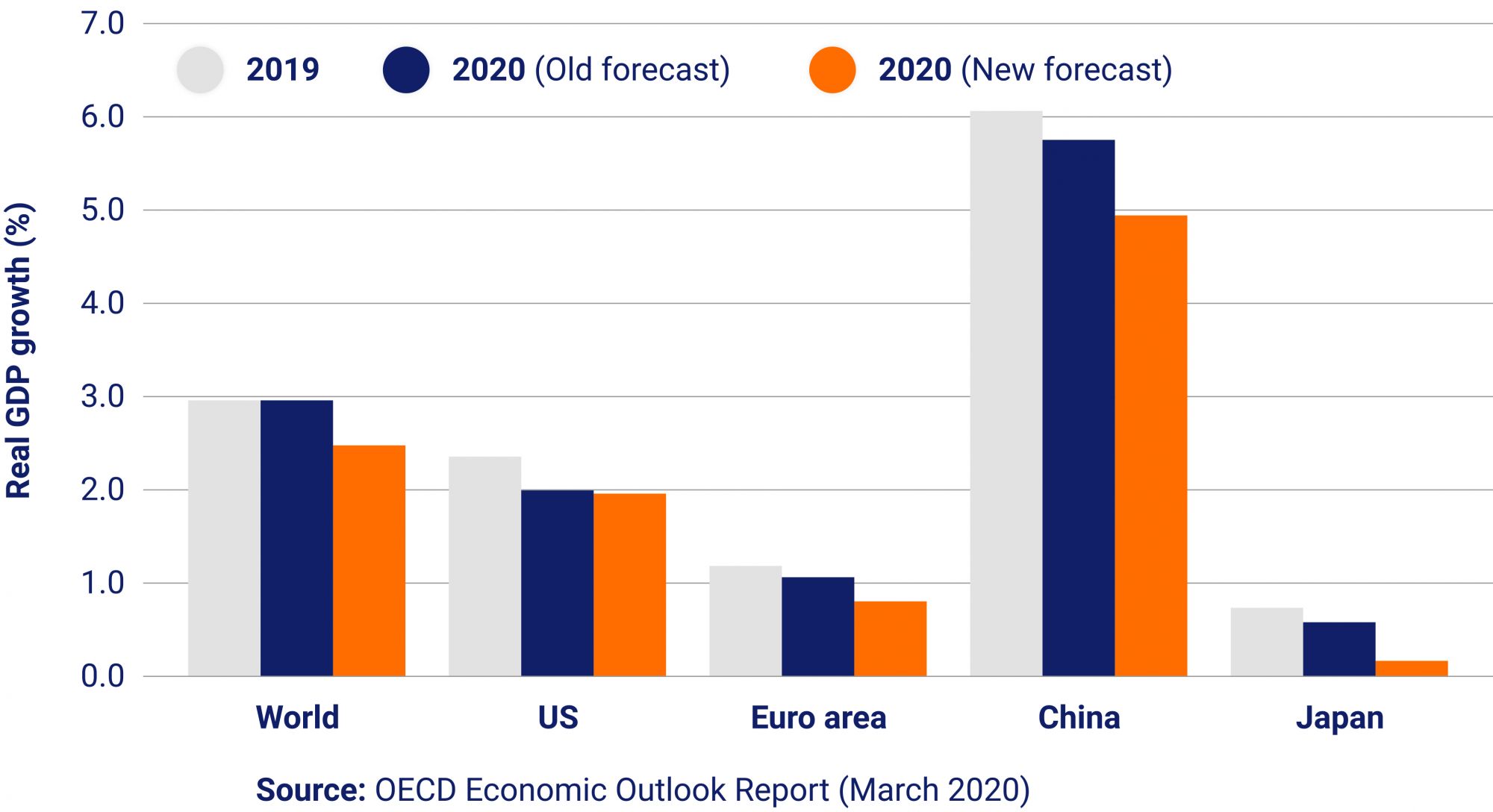

According to the OECD outlook, “The global economy faces its biggest danger since the financial crisis”. The impact of the Covid-19 outbreak on financial markets is projected to be harsh, with real GDPs growing much more slowly.

At this stage the fallout is still hard to predict. The markets are reacting constantly, but they expect governments to take proper measures and deliver economic support. For example, according to the IMF, China and South Korea have decided to ease taxes for the most vulnerable sectors and regions and to provide income and VAT tax extensions, respectively. Nevertheless, investors are preparing for the worst. For example, Goldman Sachs has revised its forecasted performance and estimated zero earnings growth, calling coronavirus the Black Swan of 2020.

What is certain is that the hit on the financial market will be considerable, with major indirect impacts. Events will continue to unfold, and the decisions of the markets and governments will evolve correspondingly.

Services