Comprehensive XVA Coverage

CompatibL Platform provides a comprehensive coverage of XVA measures, including credit, counterparty, market, trading risks, and more.

Credit Risk

CVA, DVA, BCVA

Margin

IM, MVA

Funding

FCA, FBA, FVA

Collateral

CollVA

Capital

KVA

Liquidity

LVA

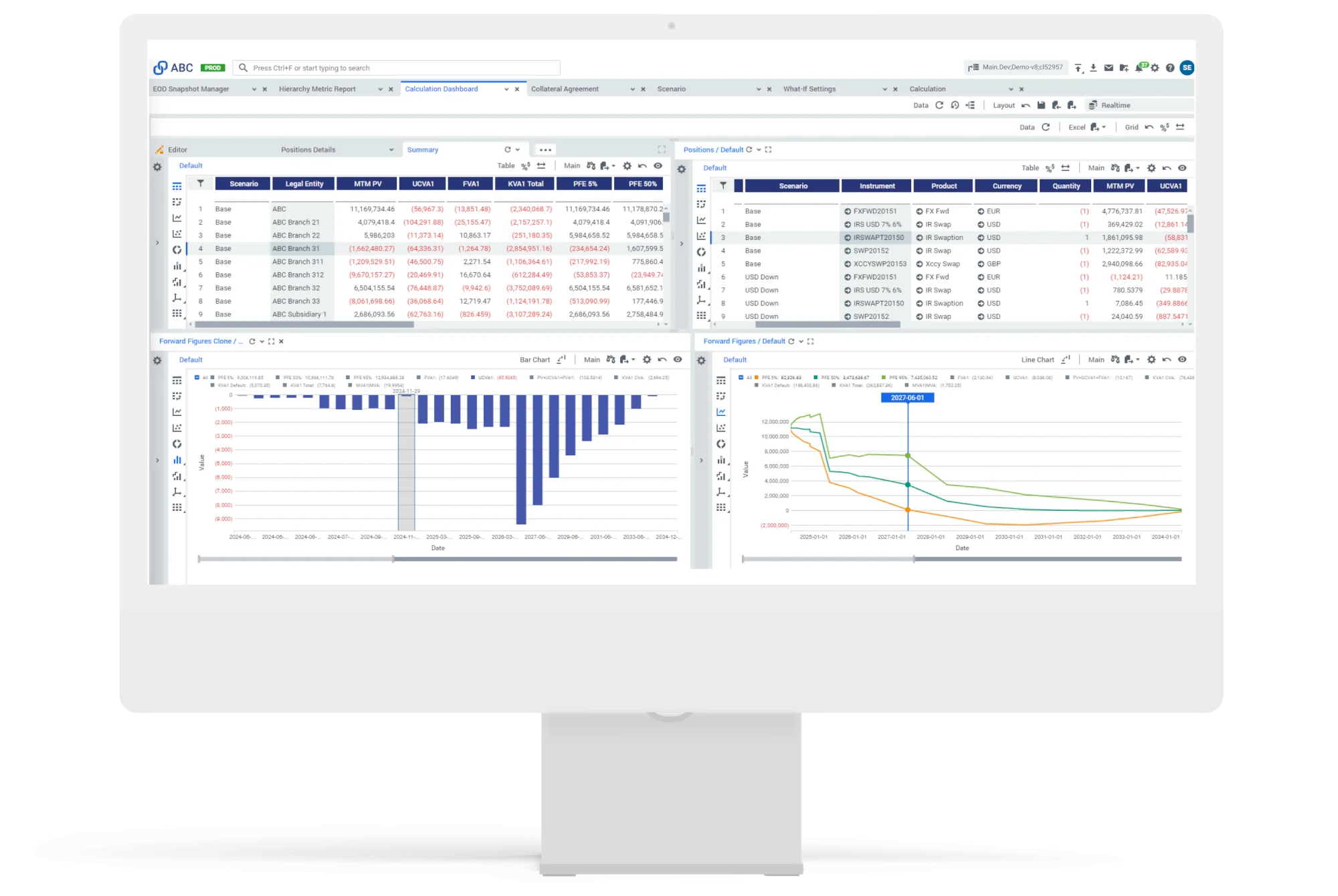

Rich Drill-Down Capabilities

CompatibL’s XVA risk management software offers advanced drill-down capabilities, with exposure and XVA contribution breakdown by portfolio, counterparty, collateral/netting/funding/initial margin sets, as well as individual trade exposures and back-allocated analytics to pinpoint risks across your portfolio.

Potential Future Exposure (PFE) Calculations

Our advanced PFE engine allows the precise modeling of the Margin Period of Risk (MPoR), Initial Margin (IM), collateral types and posting rules, and other provisions of the Credit Support Annex (CSA), allowing you to choose between full revaluation and American Monte Carlo (AMC) methods for exposure simulation. Our high-performance calculation techniques for trade valuation, which include the possibility of using default or trade-specific models, ensure path-consistent exposure aggregation.

CompatibL’s extensive set of PFE metrics allows users to browse and visualize individual PFE quantiles and 3D quantile surfaces, and to calculate expected shortfall (ES), expected tail loss (ETL), expected tail profit (ETP), and value-at-risk (VaR) to support a comprehensive exposure assessment.

CompatibL Platform for XVA offers a diverse selection of market simulation models for each asset class, along with a hybrid framework to combine and correlate them.

It provides a highly customizable setup, allowing users to parametrize model calibration, define model quality settings, analyze the states generated by the model, and accurately measure and use risk factor correlations.

The platform allows users to define the types of collateral used (e.g., cash, bonds, equity) and identify the cheapest option to post or receive collateral based on the projected market scenarios.

CompatibL Platform offers a multicurve discounting framework and incorporates CSA-aware discounting for scenario modeling, as well as the cheapest to deliver (CTD) curve and feature-rich CSA agreement parametrization.

Key Regulatory Frameworks Supported

Risk and Sensitivities

The solution offers full support for the calculation of XVA sensitivities and management of XVA risk plus the possibility to define sophisticated stress scenarios. The platform supports full PnL attribution for XVA, including advance attribution methods based on full revaluation and deltas.

In addition to market stress scenarios for XVA, users can define other scenario types, including CSA amendment scenarios, credit rating migration scenarios, and correlation shocks. CompatibL Platform supports pre-trade what-if analysis with XVA hedging as well as trade novation and compression with XVA.

Wrong-Way Risk (WWR)

Generic WWR

CompatibL Platform’s XVA simulation framework includes the ability to perform a full simulation of the counterparty credit spread as a market risk factor, correlated with all the other market risk factors of the XVA simulation model, as well as other methodologies for WWR.

Exposure Sampling

CompatibL’s unique exposure-sampling methodology uses the correlation between the exposure and the simulated credit spread, providing a simple and accurate measure of WWR without incurring significant computational cost.

Cloud Deployment and Integration

Our solution can be seamlessly integrated with your existing infrastructure using our standards-based REST API and SDKs for Python, Java, C++, and .NET. The REST API is the best choice for implementing upstream and downstream feeds, whereas SDKs work best for the customization of analytics, including adding your bespoke pricing models and exposure calculation methodologies.

In addition to on-prem and private cloud deployments, CompatibL also offers native public cloud support managed by either CompatibL or your own IT team.

Built Around Performance

Realtime XVA Sensitivities and What-If Scenarios

Analyze XVA measures and run sensitivities in real-time. Test market impacts with what-if scenarios.

Comprehensive Analytics Suite

Leverage an extensive set of CompatibL models and analytics with full drill-down capabilities plus on-the-fly nonlinear risk and XVA aggregation.

Full Asset Class Coverage

Access an unparalleled library of vanilla and exotic pricing models across all asset classes, as well as a Python script to define bespoke instrument payoffs and templates.

API for Custom Models & Analytics

Extend your capabilities with a complete set of SDKs in Python, Java, C++, and .NET to embed your bespoke models and analytics for trade pricing and scenario generation.

Our Customers Say