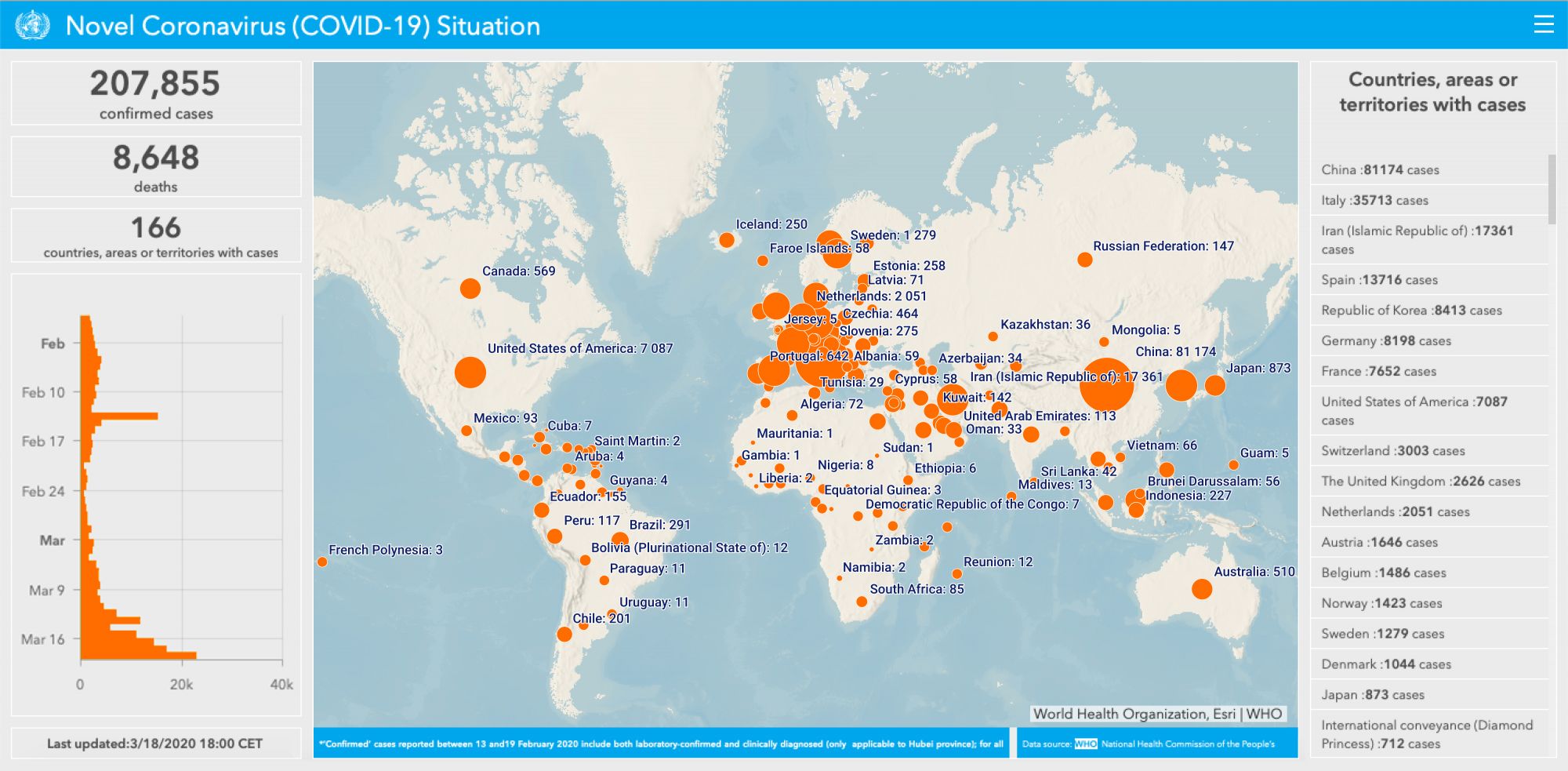

In response to the COVID-19 pandemic outbreak, governments around the globe are recommending their citizens stay at home and avoid inessential traveling. The World Health Organization encourages remote working and social distancing: maintaining a distance of at least one meter (three feet) between yourself and anyone coughing or sneezing. As a result, customers are increasingly avoiding face-to-face service to reduce the risk of infection. Social distancing is also affecting financial operations: customers now prefer contactless and cashless payments and tend to opt for online and mobile banking instead of queueing in a bank.

According to Statista, between 2012 and 2019 the number of commercial bank branches in the USA decreased steadily. The novel coronavirus outbreak may speed up this decreasing trend, not only in the USA but across the globe. The way people balance their life and work priorities are undergoing dramatic transformation. However, banks and financial institutions are already braced for these changes; for example, Lloyds Banking Group recently announced its collaboration with Google Cloud to accelerate its digital transformation and offer its customers more personalized experiences.

In addition, companies are facing the sudden need to enable the mobility of their workforce. What seemed to be a benefit has become a necessity. But working from home requires sufficient and secure remote working technologies. Cloud technologies enhance the possibility of working from home anywhere in the world through virtual desktops, web-based apps, and access to VPNs on many devices.

However, for some companies in the financial markets this has not been a sudden move: earlier this month, JPMorgan launched “Project Kennedy” to set 10% of staff working remotely in order to test its contingency plan, which is targeted at closing domestic offices. JPMorgan Chase had recognized the benefits of cloud transformation long before the coronavirus outbreak and had set up a cloud engineering center in Seattle to build the first global, multi-cloud computing platform in the USA.

The situation with COVID-19 is moving fast, and the impacts are expected to be wide ranging. Management IT services and cloud risk solutions seem to be the best options for businesses, allowing them to strengthen cybersecurity, improve compliance, and reduce costs by providing maintenance, backup and recovery, and cloud support from dedicated teams with expertise and skills, liberating the workforce to focus on business goals and tackle the economic and business effects of the coronavirus. At CompatibL, we offer cloud services and deliver IT consultancy and managed IT services to help our customers to boost their business confidence and improve their digital strategies.

Services

Widespread quarantine has not previously been seen as a typical exposure that should be included in contingency plans. The time has come, however, to rethink business continuity plans and incorporate likely coronavirus impacts in digital strategies. For financial markets, COVID-19 means an additional spike of scrutiny in terms of reputational issues and regulatory requirements. What is certain, given the multitude of challenges facing the financial markets, is that financial institutions and banks are desperate for a digital overhaul even as you read this article.