Basel Rules and Their Key Requirements

In banking, Basel Accords are an internationally agreed set of rules developed by the Basel Committee on Banking Supervision (BCBS) in response to the numerous challenges faced by the financial and capital markets. As the Bank for International Settlements (BIS) explains, the measures set minimum standards and requirements that apply to internationally active banks and financial institutions.

The BCBS regulations and requirements have no legal force. The Basel Accords are recommendations expected to be implemented by member countries. The first Basel Capital Accord was supported by G10 Governors and central banks. Today, there are 28 jurisdictions and 45 institutions, consisting of central banks and authorities responsible for banking supervision in their home countries.

| Members and representatives responsible for supervision in the banking sector | |

| Country/Jurisdiction | Institutional representative |

| Argentina | Central Bank of Argentina |

| Australia | Reserve Bank of Australia |

| Australian Prudential Regulation Authority | |

| Belgium | National Bank of Belgium |

| Brazil | Central Bank of Brazil |

| Canada | Bank of Canada |

| Office of the Superintendent of Financial Institutions | |

| China | People’s Bank of China |

| China Banking Regulatory Commission | |

| European Union | European Central Bank |

| European Central Bank Single Supervisory Mechanism | |

| France | Bank of France |

| Prudential Supervision and Resolution Authority | |

| Germany | Deutsche Bundesbank |

| Federal Financial Supervisory Authority (BaFin) | |

| Hong Kong SAR | Hong Kong Monetary Authority |

| India | Reserve Bank of India (RBI) |

| Indonesia | Bank Indonesia |

| Indonesia Financial Services Authority | |

| Italy | Bank of Italy |

| Japan | Bank of Japan |

| Financial Services Agency | |

| Korea | Bank of Korea |

| Financial Supervisory Service | |

| Luxembourg | Commission de Surveillance du Secteur Financier (CSSF) |

| Mexico | Banco de México |

| Comisión Nacional Bancaria y de Valores | |

| Netherlands | De Nederlandsche Bank |

| Russia | Central Bank of the Russian Federation |

| Saudi Arabia | Saudi Arabian Monetary Agency |

| Singapore | Monetary Authority of Singapore |

| South Africa | South African Reserve Bank |

| Spain | Banco de España |

| Sweden | Sveriges Riksbank |

| Finansinspektionen | |

| Switzerland | Swiss National Bank |

| Swiss Financial Market Supervisory Authority (FINMA) | |

| Turkey | Central Bank of the Republic of Turkey |

| Banking Regulation and Supervision Agency | |

| United Kingdom | Bank of England |

| Prudential Regulation Authority | |

| USA | Board of Governors of the Federal Reserve System |

| Federal Reserve Bank of New York | |

| Office of the Comptroller of the Currency | |

| Federal Deposit Insurance Corporation | |

| Observers | |

| Country | Institutional representative |

| Chile | Central Bank of Chile |

| Banking and Financial Institutions Supervisory Agency | |

| Malaysia | Central Bank of Malaysia |

| United Arab Emirates | Central Bank of the United Arab Emirates |

| Supervisory groups, international agencies and other bodies | |

| Bank for International Settlements | |

| Basel Consultative Group | |

| European Banking Authority | |

| European Commission | |

| International Monetary Fund | |

| Secretariat | |

| Bank for International Settlements | |

Basel Committee membership, institutions, and representatives responsible for supervision in the banking sector

All the members, groups, agencies, and bodies responsible for supervision have played a vital part in formulating the BCBS’s core principles. These form a basis for the supervisory system and standards that are further explained and embodied in the Basel framework.

Known as Basel I, II, and III, the Basel Accords consist of three sequential banking regulations set by the BCBS.

As part of its mandate, it provides recommendations on banking and financial regulations, specifically those pertaining to capital risk, market risk, and operational risk.

The Basel Accords and Their Principles

| Basel I (issued in 1988) |

This accord aimed to tackle credit risk. With this accord the BCBS established a bank asset classification and lowered many risk profiles, which boosted investments. This paved the way for the best practices and regulations in the banking sector. |

| Basel II (issued in 2004) |

The major aim of this accord was to strengthen capital requirements and set up the regulatory review framework. This accord and its updates and amendments aimed to make bank’s capital more risk-sensitive, promote risk management for large banks, and establish standardized techniques and approaches to evaluating banks in non-EU countries. |

| Basel III (issued in 2009) |

This accord came as a response to the global financial crisis. It aimed at reforming and enhancing the regulation, supervision, and risk management within the entire banking sector. Based on the two previous Basel Accords, Basel III focused on individual banks’ ability to withstand financial stresses and mitigate system-wide shocks. |

Evolution of Basel norms in banking: Basel I, Basel II, Basel III

The Basel Accords continued to develop. Thus, from 2012 through 2017, the Committee addressed the issues of banks’ exposure to central counterparties, margin requirements, measurement of counterparty credit risk exposures, and calculation of capital requirements for securitizations. They did this by introducing the Fundamental Review of the Trading Book (FRTB) capital requirements and enhancements to the framework for disclosure requirements.

In 2017, new standards were put in place for the calculation of capital requirements for credit risk, credit valuation adjustment risk, and operation risk. One of the objectives of these new standards was to reduce the excessive variability of risk-weighted assets (RWA), which we will discuss further below.

The Basel III framework addressed a number of shortcomings and provided a foundation for more resilient banking. But the ongoing reform of Basel III and its implementation have revealed further systemic vulnerabilities.

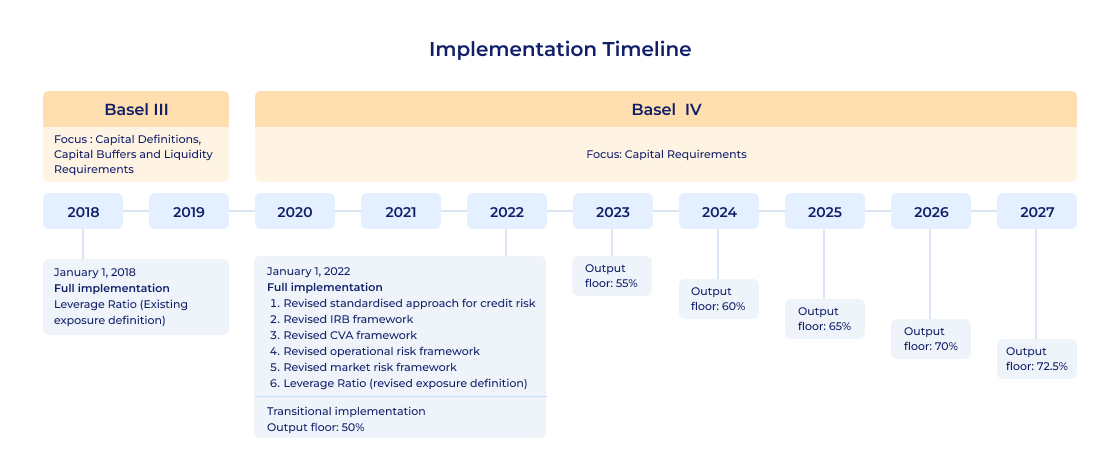

Basel III Implementation Date

When Basel III was published by the Basel Committee on Banking Supervision in November 2010, it was originally scheduled to come into effect between 2013 and 2015. However, its implementation was repeatedly extended, first to January 1, 2022, and then again until January 1, 2023, as a result of the COVID-19 pandemic.

| 2017 reforms | Implementation date |

|

Revised standardized approach for credit risk |

January 1, 2023 |

|

Revised internal ratings-based framework for credit risk |

January 1, 2023 |

|

Revised credit valuation adjustment framework |

January 1, 2023 |

|

Revised operational risk framework |

January 1, 2023 |

|

Revised market risk framework |

January 1, 2023 |

| Leverage ration | Existing exposure definition: January 1, 2018 |

| Revised exposure definition: January 1, 2023 |

|

|

Global systemically important bank (G-SIB) buffer: |

|

| Output floor |

January 1, 2022: 50% |

|

January 1, 2023: 55% |

|

|

January 1, 2024: 60% |

|

|

January 1, 2025: 65% |

|

|

January 1, 2026: 70% |

|

|

January 1, 2027: 72.5% |

Basel III Capital Requirements and the Financial Crisis

The reasons for the global financial crisis are quite complex. Before the 2008 crisis, there was a period of excess liquidity, which became partially invisible for many banks and supervisors. Subsequently, the banks discovered they had insufficient liquidity reserves to meet their obligations, while the quality of their capital was also inadequate. Basel III, being the biggest regulatory change to date, allowed the reform of the entire banking sector landscape.

Based on Basel III capital requirements, banks must maintain a minimum of 4.5% common equity as a percentage of their risk-weighted assets, compared with 2% under Basel II. The total minimum capital requirement for Basel compliance is 7%, with an additional 2.5% buffer capital requirement.

If a bank faces financial stress, it can use the buffer, but doing so can lead to even more financial constraints when it pays dividends.

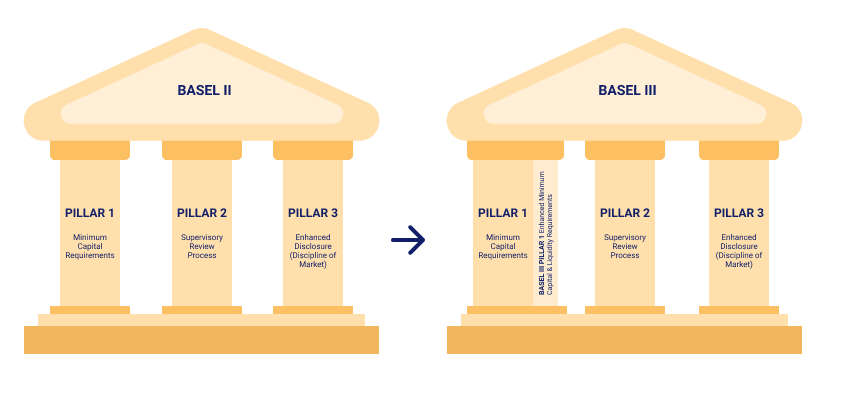

Basel III retained the three pillars from Basel II:

- Pillar 1 establishes regulatory capital requirements for calculating credit, operational, and market risks

- Pillar 2 sets out a process for reviewing the overall capital adequacy by banks and a process for supervisors to evaluate how banks assess their risks

- Pillar 3 outlines disclosure requirements

However, in addition, Pillar 1 was reinforced with capital and liquidity requirements.

Moreover, Basel III introduced two liquidity ratios: the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR). These two ratios ensure a sufficient level of high-quality liquid assets and promote resilience over a longer time horizon, respectively.

We should also mention that changes to Pillar 1 introduced the Capital Adequacy Ratio (CAR) and, in particular, the definition of capital and minimum CAR requirements, for which the BCBS issued a consultative document on the FRTB, which outlines market risk requirements such as:

- Stricter definition of tools and instruments applied to the trading book

- Longer periods for value-at-risk calculations

- Use of correlations under the standardized approach

According to the OECD Journal, Basel II never properly came into effect due to the crisis. Under Basel III, the Basel Committee introduced changes to capital requirements, such as raising the quality, consistency, and transparency of the capital base, enhancing risk coverage, introducing the leverage ratio, and considering the role of procyclical factors, though it failed to address some major concerns, particularly about the changes to the risk-weighted asset framework.

From Basel III to Basel IV: What Changed?

Basel IV, also known as Basel 3.1, is one of the hottest topics in the banking industry, and with good reason. Basel IV will increase capital requirements for undercapitalized banks, and the BCBS has proposed certain measures to fulfill this goal. Basel IV (Basel 3.1) is scheduled to be implemented on January 1, 2023.

Basel I offered quite simple risk weights focusing on credit risk and offering a market risk component. However, in 2012, according to the European Parliament briefing, the BCBS initiated a comprehensive review of the risk-weighted capital framework to finalize the Basel III norms and strengthen the resilience of the global banking system.

In 2017, the Basel Committee published finalized rules covering major issues associated with RWA. These rules outline fundamental changes to calculating capital ratio and RWA by all banks, no matter their size or the complexity of their banking model. Such changes were deemed to be the “finalization” of the Basel III package of reforms (Basel 3.1). Nevertheless, many experts consider this the beginning of the new Basel IV Accord, due to the scale of the modifications (compiled by Deloitte).

Securitization framework

The securitization framework sets out revised methodologies for the calculation of regulatory capital requirements for securitization exposures held by banks in their banking book.

- Introduction of simple, transparent, and comparable criteria

The criteria cover asset risk, structural risk, fiduciary, and servicer risk in a securitization as well as for capital purposes. For a securitization that meets these criteria, banks may see lower regulatory capital requirements using the new approaches. However, the determination of the approach will rely heavily on the amount of data available as well as national jurisdiction.

- Revised hierarchy of approaches

Multiple approaches have been streamlined into just three approaches, and the criteria for determining each approach shifted from the responsibility of the bank to the reliance on information available.

Capital floor

To allow better comparison between the standardized and internal model approaches and increase the credibility of risk-weighted calculations, banks using the internal model approach will face a limit on the calculation of capital relative to the standardized approach under the revised capital floor.

The new approach will allow banks to calculate their RWA as the higher of:

- Total RWA calculated under the approach approved by their regulator

- 5% of the total RWA calculated using the standardized approach

The total RWA calculated cannot be less than 72.5% RWA determined by the standardized approach.

Subject to national discretion, regulators may cap the increase in total RWA at 25% of the bank’s RWA as banks adjust for the output floor during the transitional period.

Leverage ratio framework

Changes made to the leverage ratio framework include refinements to the leverage ratio exposure measure and introduction of a new leverage ratio buffer for G-SIBs.

- Refinements to the leverage ratio exposure measure

The leverage ratio will restrict the accumulation of leverage that risk downward pressure on asset prices as banks rush to deleverage in times of financial crisis and strengthen the risk-based capital requirements with a simple measure providing a last resort security.

- Introduction of a new leverage ratio buffer for G-SIBs

The leverage ratio buffer seeks to mitigate externalities created by G-SIBs and is in line with the risk-weighted G-SIB buffer.

Operational risk framework

The BCBS has revised its principles for the sound management of operational risk. The new standardized measurement approach includes:

- Basic Indicator Approach (BIA)

- The Standardized Approach (TSA)

- Alternative Standardized Approach (ASA)

The new standardized approach is an accounting measure based on the bank’s income (business indicator component) and historical losses experience (internal loss multiplier). It assumes that the operational risk increases in an increasing rate with bank’s income and the likelihood of incurring operational risk losses increases in the future if the bank has higher historical operational risk losses.

Credit valuation adjustment (CVA)

The revised framework will account for the exposure component of CVA risks, which was not covered previously, and will be consistent with the approach set out by the revised market risk framework, the FRTB.

- Introduction of new eligibility criteria for CVA hedges

| BA-CVA | SA-CVA |

|

|

- Introduction of a materiality threshold

A bank that has an aggregate notional amount of non-centrally cleared derivatives that is less than or equal to €100 billion may choose to set its CVA capital equal to 100% of its capital requirement for counterparty credit risk (CCR).

Market risk

The BCBS more clearly defined the regulatory boundary between banking and the trading book. It has further set out guidance to help banks with classification of the instruments in the trading and banking books based on the liquidity of instruments and the ability to value them on a daily basis.

Additional classification guidelines were introduced for:

- The trading book and banking book, with a stringent approach to the movement of instruments between books

- Capital recognition for internal transfer from the trading book to the banking book

The Committee outlined requirements for treatment of risk transfers from the banking book to the trading book:

- Banking book credit risk exposures using internal risk transfer with trading book

- Banking book interest risk exposures using internal risk transfer with trading book

- Banking book equity risk exposures using a hedge instrument purchase from the marker through its trading book The Committee also revised approaches to market risk.

The standardized approach for market risk

Using elements from the former standardized measurement method, the sensitivities-based method builds on the elements and expands the use of delta, vega, and curvature risk to factor sensitivities.

The standardized approach capital charge is the sum of:

- The sensitivities-based method capital charge

- The default risk charge

- The residual add-on

The internal model approach for market risk

The main changes for the internal model approach for FRTB are:

- A more stringent approval process by the supervisory authority

- More consistent identification of material risk factors across banks

Credit risk

Banking and markets may face unprecedented regulatory shocks in the wake of the Basel IV credit risk rule: risk-weighted assets will likely rise by two-digit percentages, the output floor is expected to weigh heavily on banks using the internal-ratings-based (IRB) approach, and the mortgage business will be adversely affected.

As a general view, the implications will be varied—from specific product areas such as mortgage lending to effects on strategic funding.

The standardized approach for credit risk

The revision by the BCBS seeks to improve the granularity and risk sensitivity of the standardized approach.

Improvements:

- Exposure to banks—introduction to the Standardized Credit Risk Assessment Approach (SCRA)

- Exposure to corporates—introduction of risk weights for small and medium-sized enterprises and investment grade corporates

- Residential real estate exposure—risk weights will vary based on the loan-to-value (LTV) ratio of the mortgage to replace a flat weighting of 35%

- Retail exposure—a more granular table has been introduced to distinguish different types of regulatory retail exposures

- Exposure to commercial real estate—introduction of the LTV ratio approach to replace a flat weighting of 100%

- Exposure to subordinated debts and equity—the existing flat risk weight of 100% or 250% will be replaced by 150% subordinated debt and capital other than equities, 100% for equity holdings made pursuant to national legislated programs, 400% to speculative unlisted equity exposures and 250% for all other equity exposures

- Exposure to off-balance-sheet items—a 100% credit conversion factor (CCF) will now apply for commitment referring to any contractual arrangement that has been offered by the bank and accepted by the client to extend credit, purchase assets, or issue credit substitutes compared with the 20% and 50% set out in BCBS 128 for maturities of one year and more than one year, respectively. A 10% CCF will replace the 0% CCF for commitments that are unconditionally cancellable at any time by the bank without prior notice, or that effectively provide for automatic cancellation due to deterioration in a borrower’s creditworthiness.

New items:

- Exposure to covered bonds—new risk weights for rated and unrated exposure

- Exposure to project finance, object, and commodities finance—risk weights for rated exposures will follow the general corporates, and three subcategories of specialized lending are introduced to improve granularity

The internal rating-based approach for credit risk

The probability of default (PD) floor was recalibrated, and loss given default (LGD) and exposure at default (EAD) floors were introduced:

- Recalibration of PD floors for the F-IRB and A-IRB approaches

- Introduction of LGD and EAD floors for the A-IRB approach for corporate and retail exposures

- Adjustments to LGD were made for the F-IRB approach

In addition to the removal of the 1.06 scaling factor currently applied to RWA, the revision by the Committee removed the IRB approach for some of the exposures.

Basel IV Implementation Date

Basel IV’s implementation date of January 1, 2023, is rapidly approaching, with banks in the EU, UK, and US eagerly awaiting further details regarding what will be required of them. Although some banks have questioned the timing, regulators remain steadfast in their goal to complete the final reforms.

Keep in mind, however, that as a result of the pandemic and the upcoming regulatory process, the implementation of Basel IV (Basel 3.1) has already been put on hold once.

It is important to note that the impact of Basel IV may vary by location as well as by the type and business model of certain banks. It is time for banks to work out their own capital management strategies in order to be ready for Basel IV. The development of such strategies requires extensive knowledge and expertise.

The winds of change regarding Basel IV have already forced some larger banks to apply advanced modeling and optimization approaches and even to review their legal entity setup. There are many areas to consider while maintaining the pace of capital efficiency: product offerings, policies on collateral and guarantees, repricing, management of costs, etc.

What is more, the technical side may become a major challenge. How to calculate RWA accurately? How to ensure the data is complete and used appropriately?

We strongly recommend considering investing in technical tools and implementing efficient capital management approaches.

At CompatibL, we help our clients adjust their strategies in line with the forthcoming requirements and understand the evolving regulatory requirements.

Our risk management software supports all major regulatory frameworks, including Basel III, FRTB, ISDA SIMM, IRRBB, and SA-CCR, so you can get future-ready and compliant with the complex regulatory frameworks in a simple and transparent manner.